Financials

Our financial reports show a continuous growth since we started in 2018.

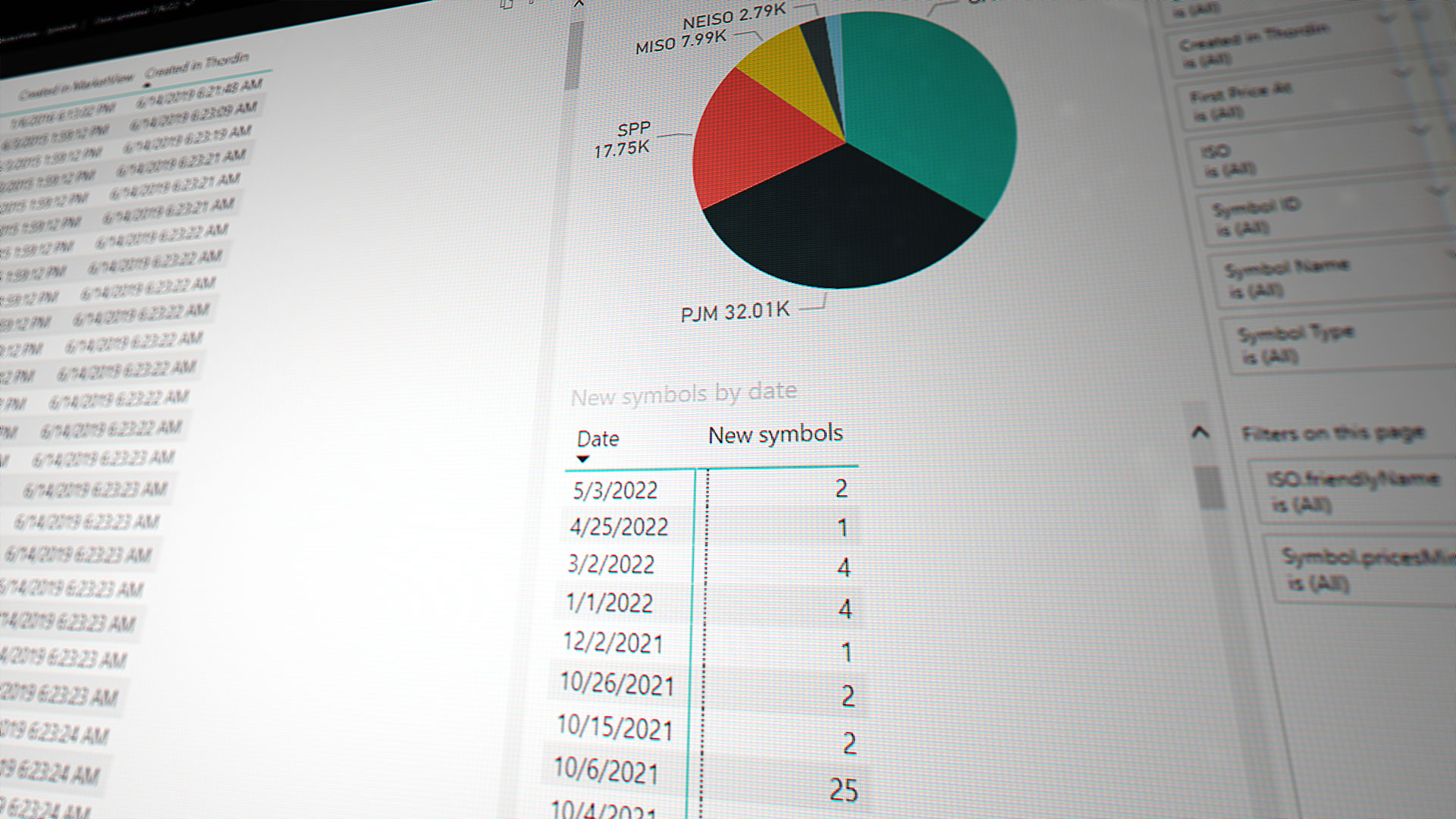

Our risk allocation strategy is based on diversification divided into four focus areas.

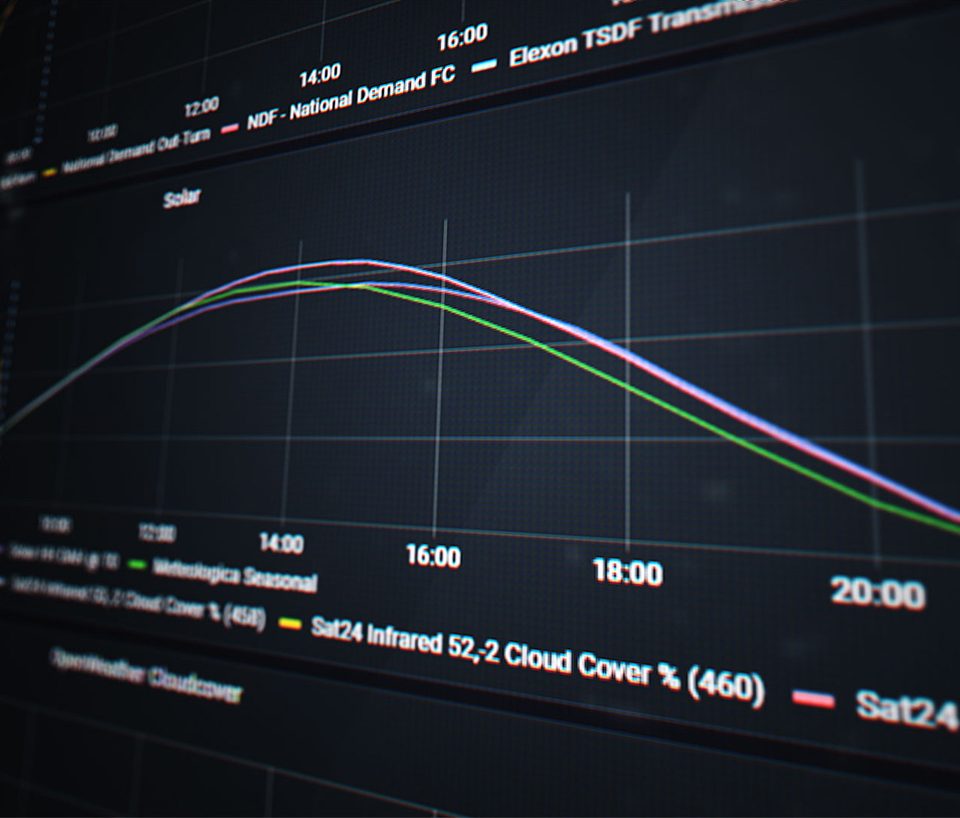

- Firstly, we spread our positions in different markets to avoid that a single market is becoming too dominant in our portfolio.

- Secondly, we keep adding new markets located far apart. Power prices are determined by the weather, and by spreading our markets on different continents, we make sure our markets are not affected by the same weather systems.

- Thirdly, when entering a new market, we start finetuning our trading strategies and only trade small amounts of MWh.

- Fourthly, once we start seeing that our trading strategies work in a new market, we turn up the volume in the market not only in the new market but in all markets to rebalance the risk profile of the Yggdrasil Group.

Please download our financial reports in PDF version below to see how we performed.